The Single Strategy To Use For Stonewell Bookkeeping

Not known Details About Stonewell Bookkeeping

Table of ContentsAbout Stonewell BookkeepingLittle Known Facts About Stonewell Bookkeeping.Unknown Facts About Stonewell BookkeepingThe Single Strategy To Use For Stonewell BookkeepingThe Only Guide for Stonewell Bookkeeping

Rather of going via a declaring closet of different documents, invoices, and receipts, you can provide thorough documents to your accountant. After utilizing your accountancy to submit your tax obligations, the IRS may pick to perform an audit.

That funding can come in the form of owner's equity, gives, business fundings, and financiers. Financiers need to have a good concept of your organization prior to spending.

The Facts About Stonewell Bookkeeping Uncovered

This is not meant as legal recommendations; for even more info, please visit this site..

We addressed, "well, in order to understand just how much you require to be paying, we need to know just how much you're making. What are your incomes like? What is your net revenue? Are you in any type of debt?" There was a lengthy pause. "Well, I have $179,000 in my account, so I presume my web income (earnings less expenditures) is $18K".

Stonewell Bookkeeping Fundamentals Explained

While it could be that they have $18K in the account (and even that may not be real), your equilibrium in the financial institution does not always establish your profit. If someone received a grant or a financing, those funds are not considered income. And they would not function right into your earnings declaration in establishing your earnings.

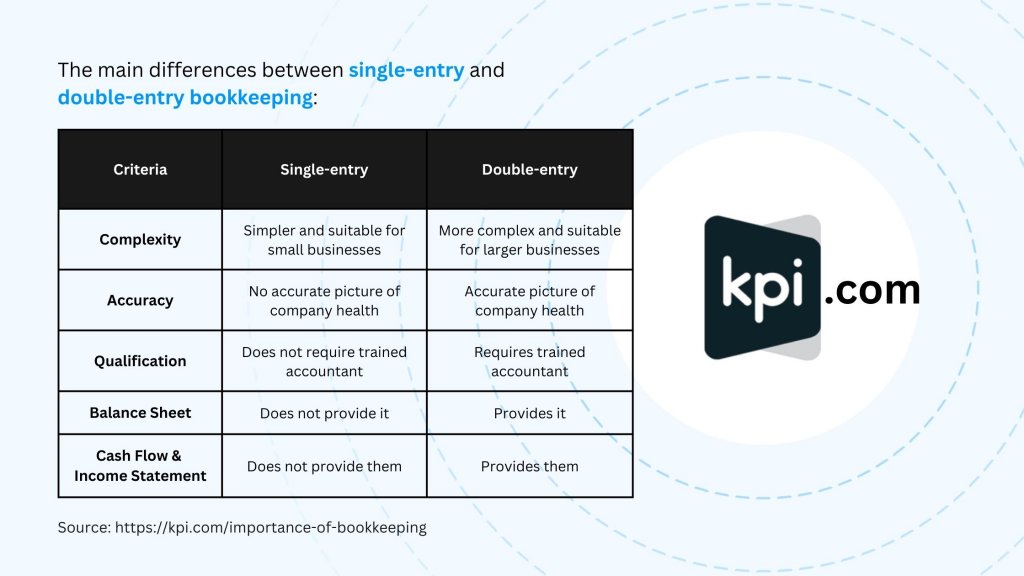

Many things that you believe are costs and deductions are in truth neither. Bookkeeping is the process of recording, classifying, and organizing a company's financial transactions and tax filings.

A successful company calls for help from specialists. With reasonable goals and a competent bookkeeper, you can easily deal with difficulties and maintain those concerns at bay. We dedicate our power to guaranteeing you have a strong monetary structure for development.

See This Report about Stonewell Bookkeeping

Exact bookkeeping is the foundation of great economic administration in any organization. With good accounting, companies can make better choices because clear monetary records supply important information that can direct strategy and improve profits.

Accurate monetary declarations construct trust with loan providers and capitalists, enhancing your possibilities of obtaining the resources you require to expand., businesses ought to on a regular basis integrate their accounts.

They assure on-time payment of bills and quick consumer settlement of invoices. This improves money flow and assists to prevent late fines. A bookkeeper will cross bank statements with internal records address at the very least as soon as a month to locate blunders or inconsistencies. Called bank reconciliation, this procedure assures that the economic documents of the business suit those of the bank.

They monitor existing pay-roll data, deduct tax obligations, and number pay scales. Accountants create fundamental monetary reports, consisting of: Revenue and Loss Statements Reveals profits, costs, and internet profit. Annual report Provides properties, liabilities, and equity. Capital Statements Tracks cash money activity in and out of business (https://zenwriting.net/hirestonewell/y5xfi42sw6). These reports assist company owner understand their financial setting and make notified choices.

Everything about Stonewell Bookkeeping

The most effective selection relies on your budget plan and company needs. Some tiny organization owners choose to handle accounting themselves utilizing software application. While this is affordable, it can be taxing and susceptible to errors. Devices like copyright, Xero, and FreshBooks enable local business owner to automate bookkeeping jobs. These programs aid with invoicing, financial institution settlement, and financial coverage.